How to invest in gold?

Gold is considered the ultimate safe-haven asset. This is particularly true in times of economic crisis or geopolitical tension, when the price of gold rises. As a result, the yellow metal is now the 4th most popular savings solution for the French, after real estate, life insurance and cash deposits. Discover how to invest in gold and the reasons why this precious metal is a safe haven with Abacor, specialized ingold buying and selling since 1996.

Contact an Expert :

01 48 04 76 06 Form Nos Comptoirs de l'Or >

Buy Gold at the Best Price in Paris

Buy gold in Paris at the best price with Abacor, the French precious metals company. For over 22 years, Abacor has been offering professionalgold buying, investing and selling services.

Would you like to become a gold investor? We offer you the opportunity toinvest in physical gold in the form of gold coins and gold bars.

As a private and independent company, we are able to offer you gold purchase prices without depending on a franchise or other companies and organizations.

Our experts welcome you to our Paris branches to advise you on investing in gold. They will give you free, no-obligation advice on your project, and will draw up a quotation based on the real-time price of gold and the market price of gold on the stock exchange, so that you caninvest in gold at the best price on the gold market.

Free advice, no-obligation quotation.

Investing in gold, the safe haven?

Gold, a safe haven

In a climate of global economic crisis, inflation risk and financial market volatility, gold has always been and is increasingly seen by traders and economic and financial experts as the ultimate safe haven.

The yellow metal has always served as a safe haven in times of crisis, particularly when the economic situation of a country or region deteriorated or even collapsed during a financial crisis, banking system crash or government bankruptcy. Unaffected by inflation, gold is the only precious metal that can replace any currency.

Investing in gold allows you to safeguard your savings and protect your assets. Unlike any other commodity, resale provides immediate liquidity.

Demand for gold continues to grow, while supply is limited by its scarcity. As a result, the yellow metal offers a stability that governments and central banks cannot always guarantee.

Contact an Expert :

01 48 04 76 06 Form Nos Comptoirs de l'Or >

History of Gold Prices

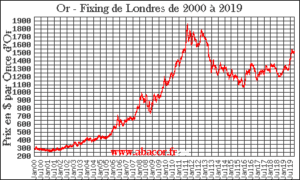

Between 2000 and 2019, the value of gold in ounces rose from around $300 to almost $1,500.

On September 6, 2011, the record price of gold almost reached $1,900 an ounce, an increase of 530% in just over 11 years.

The evolution of the gold price reflects a real interest in this safe-haven asset on the part of investors and financial players. Particularly in times of doubt about the global economy, they tend to invest in physical gold instead of stock market investments.

Investors are very confident that the price of gold will continue to rise over the long term.

You must be logged in to post a comment.