Accueil » Achat & Vente Or » Informations sur l'Or »

Is it possible to sell gold abroad?

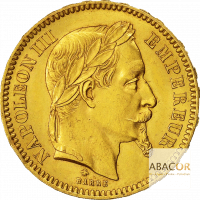

When we want to sell gold, we look for the most attractive way to do it. You've probably consulted the information on gold and know that the sale of gold in France is subject to less advantageous taxation than in other countries. So it's only natural to try to sell gold abroad, especially in neighboring countries, given the proximity of the French state.

Selling your gold abroad

It's perfectly possible to sell physical gold abroad, anywhere in the world. However, you need to take into account the reality of taxation, transport and customs costs.

Gold prices worldwide

The price of gold is international and valid all over the world. Whether you want to sell gold in Switzerland, Spain, Luxembourg or Dubai, it will have the same value. So beware of foreign gold merchants who advertise prices much higher than those for buying back gold in France.

Foreign gold tax

Taxation on the sale of gold varies from country to country. It can also be determined by the seller's tax residency status. For example, if you sell gold abroad as a French tax resident, you will have to pay French tax. However, buying back gold for melting is totally tax-exempt in France.

Transport costs

As physical gold is a precious metal of great value, the gold seller will be obliged to take into account the insurance required to send or transfer his goods abroad.

Questions relating to the cost of transporting gold are therefore an additional expense. In principle, the further away the market, the higher the transport costs.

Customs fees

Firstly, you should know that cash, cheques, shares, bonds or precious metals (including any gold you wish to sell abroad) worth 10,000 euros or more must be declared to customs by anyone entering or leaving the country. This formality is free but compulsory. Failure to do so constitutes a breach of the obligation to declare.

On the other hand, when crossing a border, the seller of the gold may have to pay customs duties. Each time a border is crossed, different customs charges are levied, depending on the country crossed, and these can amount to as much as 28% of the total value of the physical gold being transported.

As you can see, selling gold beyond our borders means taking the risk that the transaction will be less attractive.

Selling gold abroad or in France?

In conclusion, selling your gold abroad doesn't get you a better price, the only difference being the temptation to evade tax on your gold sale. This approach is very restrictive in terms of logistics and declaration.

What's more, it's always less risky to use a recognized company than to trust one that nobody really knows. Indeed, if an individual has already sold his or her gold to a French company, it will be all the easier to trust that company. By using this company, the seller will be making a practical choice, with the assurance of benefiting from adapted, quality services.

Finally, it's much easier to take legal action in your country of residence than abroad.