By definition, physical gold is real, tangible and can be touched. It includes all gold products that you can store or have delivered to your home. Physical gold ranges from nuggets and bars to coins, medals and tokens, and even the finest jewelry.

The advantages of physical gold

We buy gold to protect ourselves against crises, or even to get out of the banking system. This is not the case withpaper gold, which is linked to the financial system. So, to safeguard your assets, you need to buy physical gold. The most suitable products for precautionary savings are gold coins and bars.

With physical gold, the buyer is totally independent of exchange platforms and is not tied to any mining company. With physical gold, you can hold it as you like, and sell it when you like. You have total control over your investment

Taxation of investment gold

The tax authorities consider gold coins and bars to be investment gold. As such, they benefit from advantages not available to gold jewelry or commemorative medals.

Investment gold is a status defined by the European Union to encourage the use of gold as a savings instrument. This means that deliveries of gold dedicated to this purpose are exempt from VAT, and not declared in the IFI.

Physical gold bullion

Gold bullion is the form in which the yellow metal is most valuable to private individuals. It's a block the size of a bar of soap that can easily be stored in a bank safe or transported.

But despite their relatively high content, gold bars are not necessarily the best alternative for saving in physical gold.

Its price is defined by the value of the gold it contains. Its price is strictly in line with the international gold price.

In addition to being illiquid and unsplittable, there is still a risk of scamming when buying this product. In 2012, cases of counterfeit 1 kilo ingots, despite being supplied with a certificate from a highly reputed foundry, found their way into the hands of traders and institutional investors.

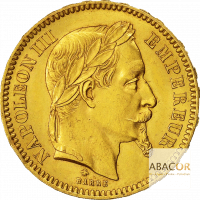

Physical gold coins

To protect yourself against crises, you should definitely turn to physical gold in the form of bullion coins. Gold coins are priced according to their own characteristics: supply and demand, and the complexity of their manufacture.

To protect yourself against crises, you should definitely turn to physical gold in the form of bullion coins. Gold coins are priced according to their own characteristics: supply and demand, and the complexity of their manufacture.

This difference between the price of a coin and its gold value is called the premium. It's a lever that helps guide an investor's actions. This premium soars in times of crisis, when everyone wants the same type of coin.

Gold bullion coins are those which contain the most fundamental elements of the yellow metal. Investment coins are all "bullion coins". These include the Krugerrand, the Chinese Panda, the American Eagle, the Canadian Maple Leaf, the Australian Nugget...

There are also less recent, more "traditional" coins, more widely recognized and quoted in France, such as the Marianne Coq, the British Souverain, the 20 Francs Suisse and the 50 Pesos from Mexico.

You must be logged in to post a comment.